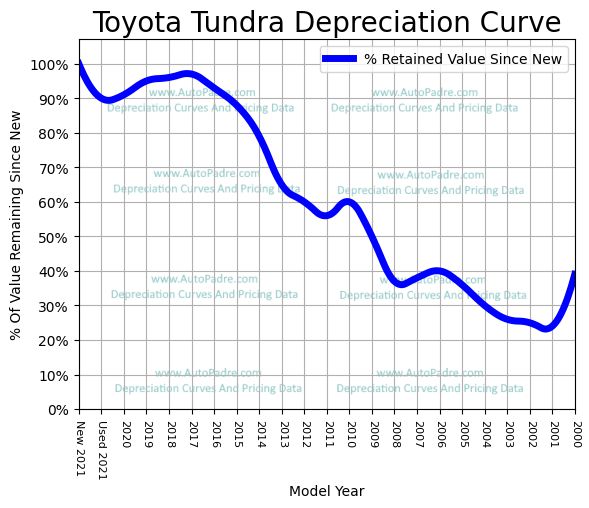

Toyota Tundra Depreciation

Jeep Wrangler 328 10824 4.

Toyota tundra depreciation. Up to 25000 of the cost of vehicles rated between 6000 lbs GVWR and 14000 lbs GVWR can be deducted using a section 179 deduction. Average 5-year depreciation difference 1. This limitation on sport utility vehicles does not impact larger commercial vehicles commuter vans or buses.

Over five years it should only lose 370 of its value. 2022 Tundra Hybrid Powertrain. It loses just 359 percent of its value or about 12000 over the first five years of its life.

An Toyota Tundra manufactured in 2021 is a go-to car of many Filipino drivers. Jeep Wrangler Unlimited 309 12168 2. Cost to own data is not currently available for the 2009 Toyota Tundra Double Cab-V8 Dbl 47L V8 5-Spd AT SR5.

According to iSeeCars the average five-year depreciation rate of the Toyota Tundra is 359 the lowest in its class. Overall over a 5-year period the site found a vehicle loses 496 of its value to depreciation. 2012 Deduction Limit 139000.

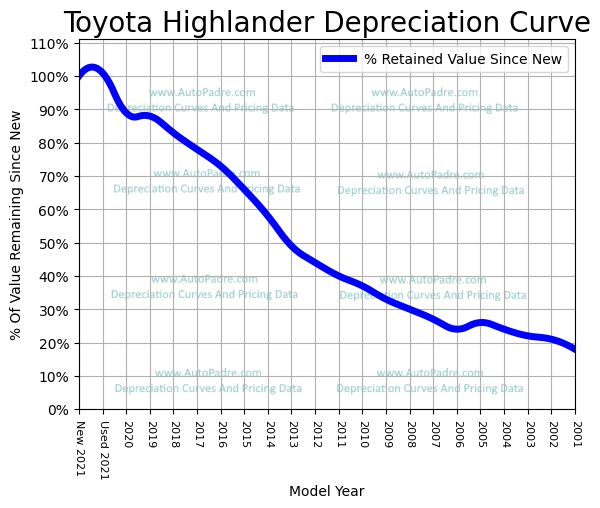

Select a Toyota from below to calculate depreciation for it. Average 5-Year Depreciation Rate 1 Jeep Wrangler Unlimited 273 2 Jeep Wrangler 273 3 Toyota Tacoma 295 4 Toyota Tundra 371 5 Nissan Frontier 378 6 Toyota 4Runner 381 7 Chevrolet Silverado 1500 397 8 GMC Sierra 1500 399 9 423. Toyota does so impressively with three models 4Runner Tacoma and Highlander ranking in the Top 10 after 5 years.

Ad Find Instant Quality Info Now. Toyota is well aware that trucks have taken on the role of family hauler. Toyota has earned a reputation for making trouble-free vehicles and that in turn is a big driver in high resale value.